When was the last time you stood in a line to collect money at a physical, brick and mortar bank? That would be ages ago, right?

Today, we prefer to do our banking online, whether from a home or office computer, or on our web-enabled smartphone. The paradigm shift to online banking was made possible by a few basic factors: technological advances that give users secure 24/7 access to their finances, online banking services’ ability to provide stellar customer service while charging customers very little, and the fact that users like the feeling of being in control.

Need of banking within an accounting software

If you have hundreds of transactions in a month, it’s great for business, but it can be overwhelming to match the balance in the bank with that in your accounting ledger. It has become necessary for accounting software to embrace advancements in banking to cater to the growing complexities of present-day businesses. Today, accounting software can fetch transactions from your bank, categorize them based on custom rules, and reconcile them in bulk, pruning the time and effort spent on manual tracking.

Let’s look at exactly how an accounting software can help you reconcile your accounts.

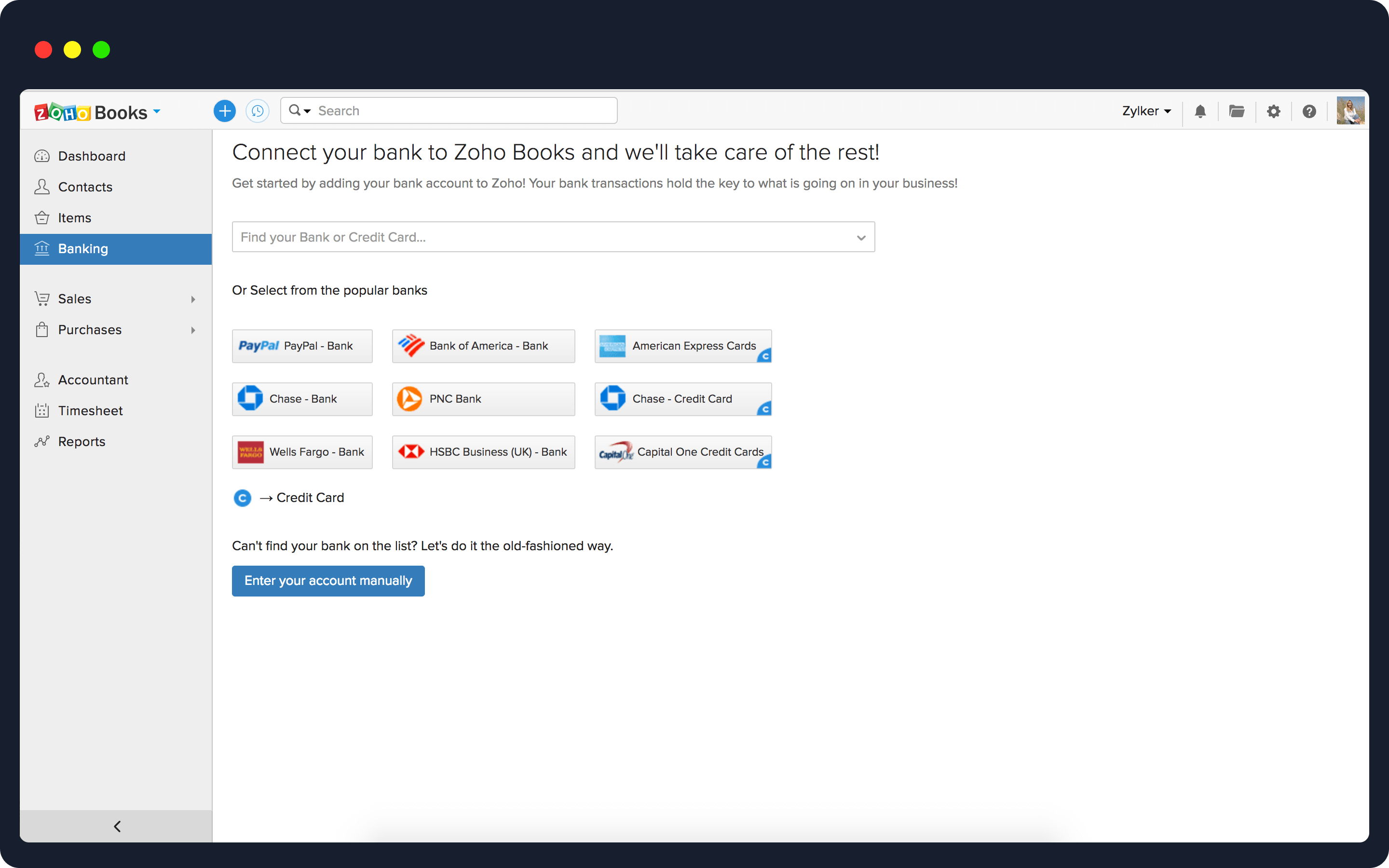

Bank feeds:- configure, connect, and import

Data aggregators like Yodlee securely connects with your bank, pulls a list of transactions, removes duplicate entries, and pushes them into your accounting software. The transactions appear with date, amount, description, and the name of the payer and the payee. Bank feeds are a boon for business owners and accountants:- no more manual data entry, less probability of error, up-to-date transaction lists, and more hours to focus on work.

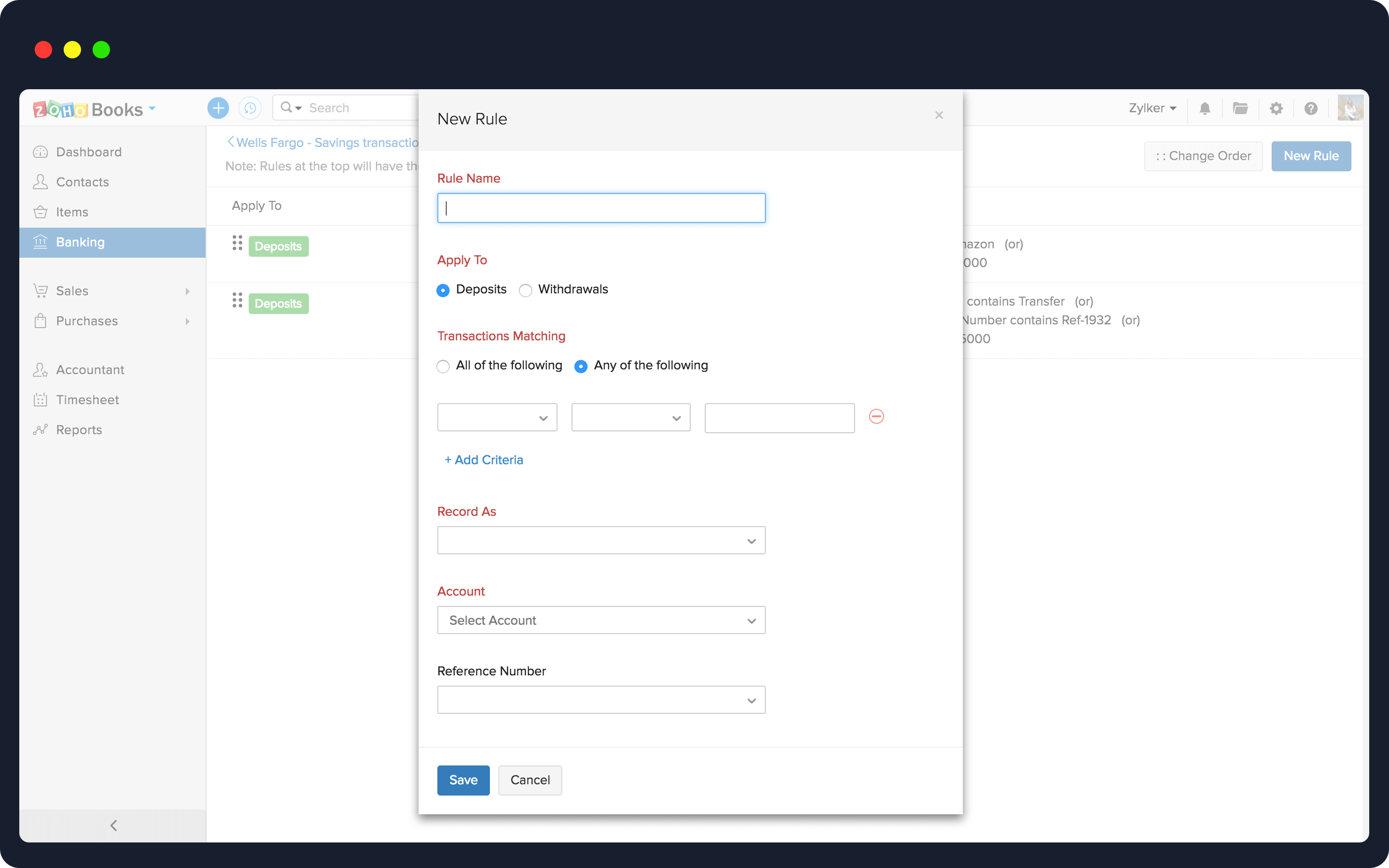

Transaction rules:- automation that saves time

Bank transactions are as sly as the emails that come in your inbox— too many in number and easy to miss out. Just like we’ve filters to identify emails and put them in a predefined folder, we have transaction rules to filter and categorize transactions. A recurring fixed transaction, like monthly office rent, can be automatically categorized as an expense based on a rule, making it one less transaction to be categorized manually.

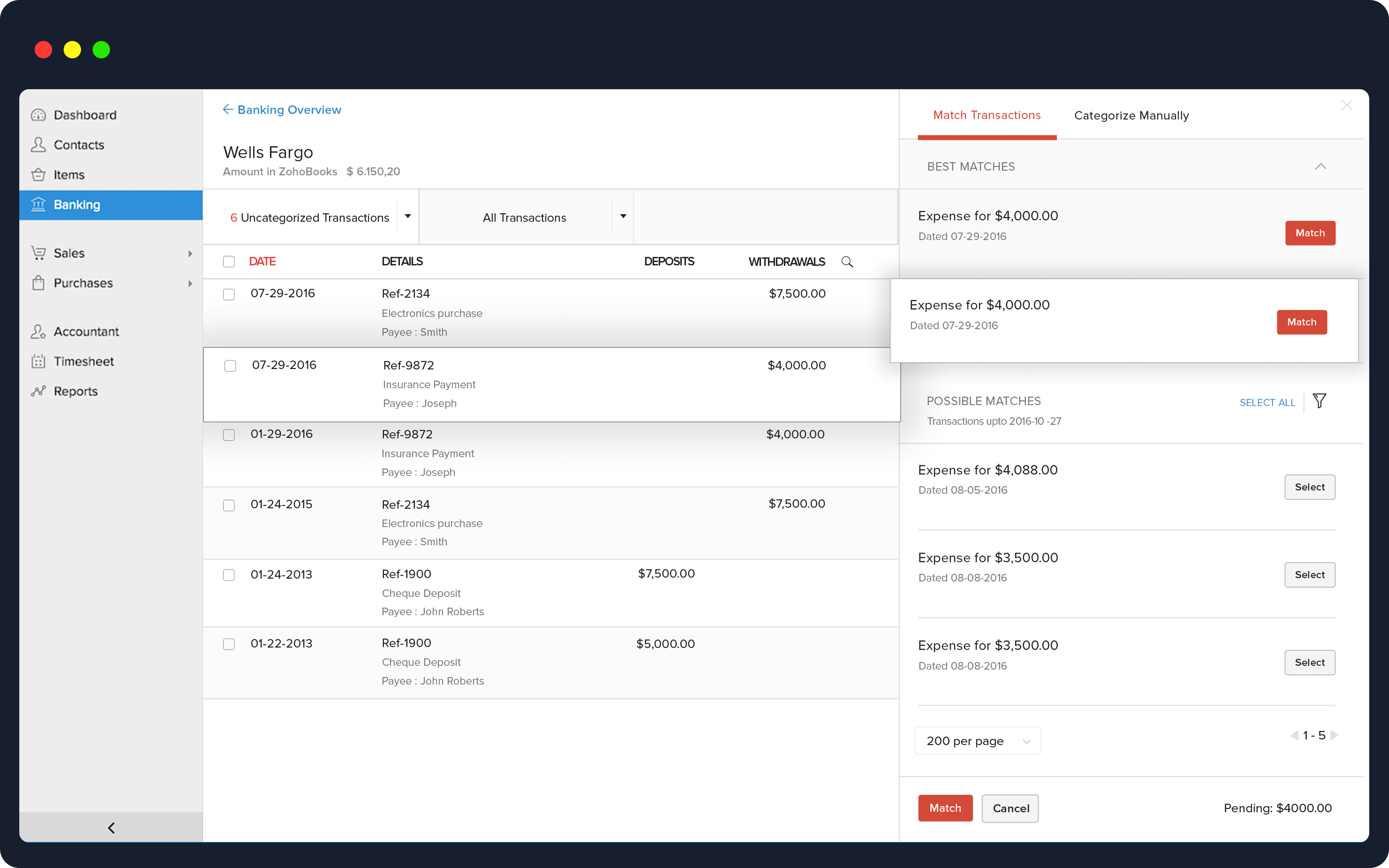

Transaction matching:- trusting the AI

Transaction matching helps you move a step closer to keeping your books in order. Cloud accounting software is more intuitive than a desktop accounting application, and its artificial intelligence (AI) makes the transaction matching process a breeze. The AI picks up an uncategorized transaction from the collected bank feed and suggests an existing one within your accounting application to match it to. The suggestions can be of two types:

Best Matches include only the transactions that are on the same date and with the same amount as the uncategorized transaction selected.

Possible Matches include all the transactions that were recorded within the last 90 days before the statement date.

These suggestions make identifying and reconciling transactions less taxing for business owners and accountants.

Bulk transactions:- the more the merrier

Do you open and delete every single spam email? Probably not. So why manage every transaction individually when you could consolidate them instead? Bulk actions are faster! With thousands of transactions sitting in your accounting software, bulk actions make it easier to select, categorize, delete, and restore past transactions.

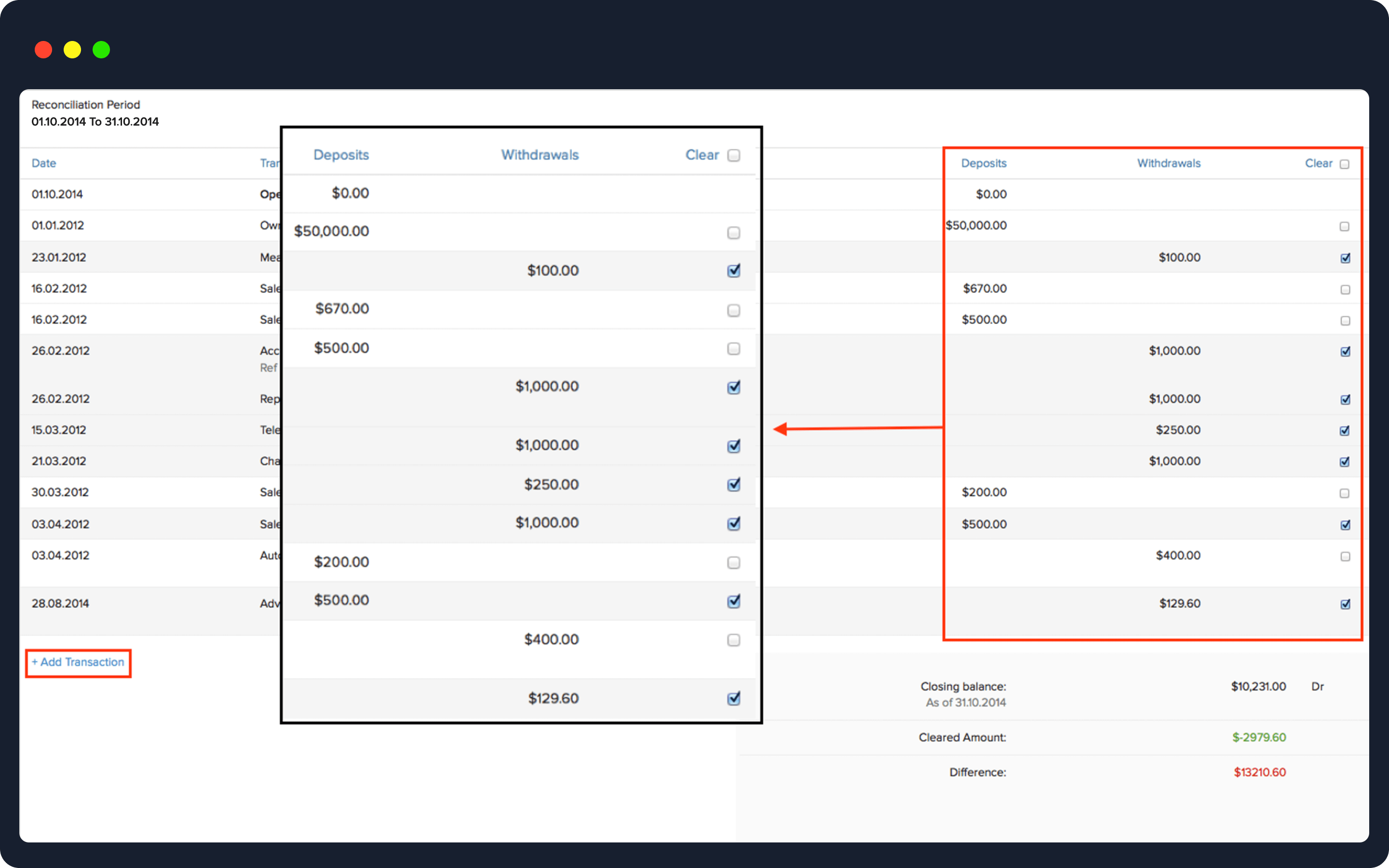

Reconciliation:- getting ready for the tax collector

Businesses must reconcile their accounts to check for frauds and to avoid balance sheet errors. Mistakes, intentional or unintentional, can attract serious action from the tax authorities. A reconciliation process syncs the closing balance for an account within the accounting software with the actual amount spent. A cloud-based accounting software reconciles all your accounts in a few clicks, so you can easily keep your business ready for the tax filing season.

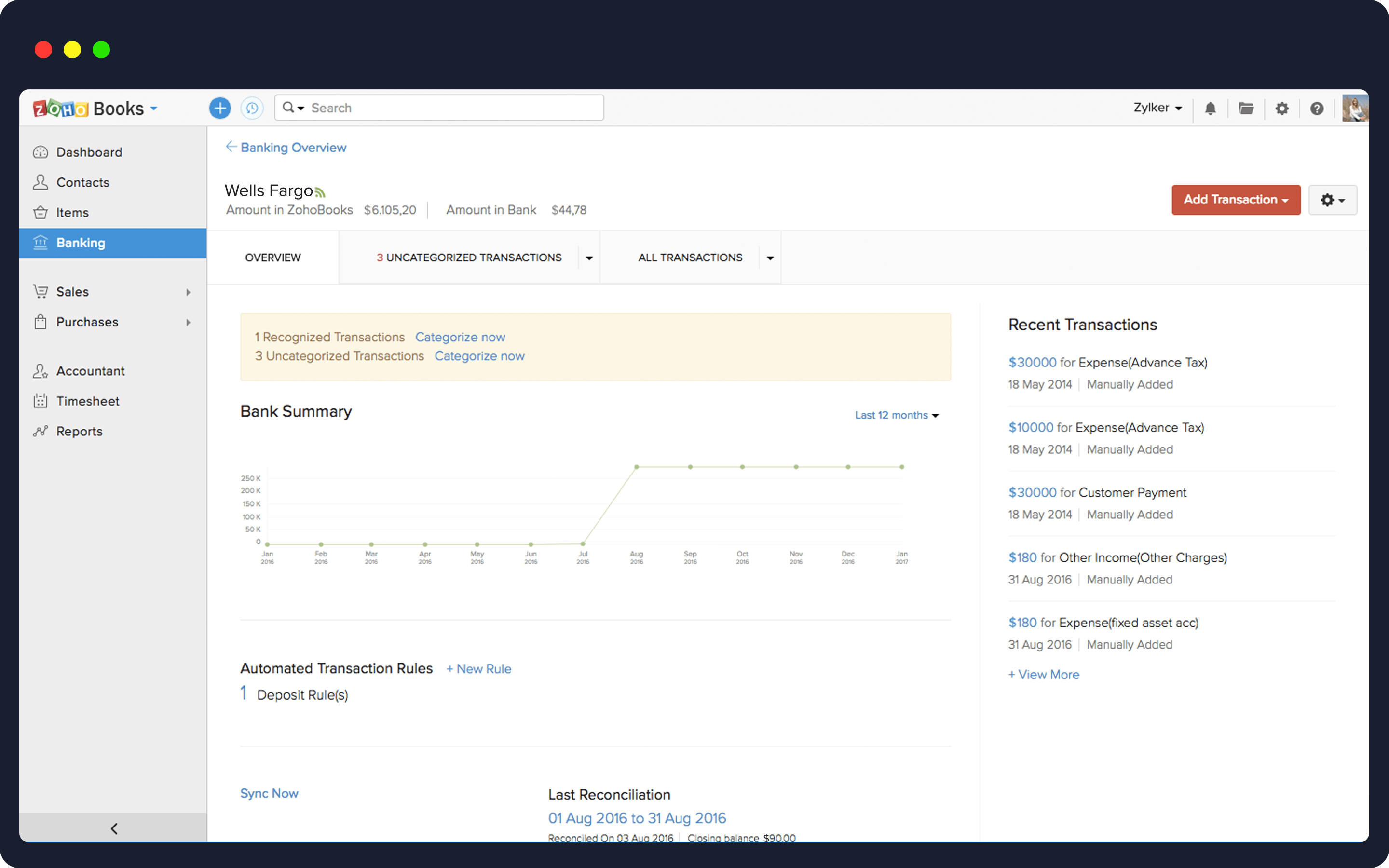

Dashboard:- a single window for account related activities

A business dashboard is a common feature of many accounting packages. It represents your performance at a macro level using the total income and expenses for a defined time period. A banking dashboard is a great complement to your business dashboard, especially for businesses that use multiple accounts to run daily operations.

Accounting software can fetch feeds from a bank account and populate the banking dashboard with actionable insights about balance mismatches, expected recurring payments, previous transactions, and past reconciliations. The dashboard helps with cashflow prediction, and is a sleek and intuitive way of representing banking activities for an account.

Special Case:- Matching deposits with withdrawals and vice versa

Consider a scenario: Patricia sells goods for $8,000 to John and sends an invoice to him for the same. Simultaneously, she receives services from him and owes $3,000. Would John make a payment of $8,000 to Patricia and wait for her to pay $3,000 in return for the services he provided? The latest accounting software offers the flexibility to let John pay $5,000 of the $8,000 owed to Patricia. The $3,000 remaining was offset by the $3,000 owed to John by Patricia.

See if for yourself

Business owners and accountants are both often short on time, whether they’re trying to grow their business or reconcile their accounts. Fortunately, accounting software has evolved for good. An advanced banking module can save you countless hours by eliminating painstaking data entry, overcoming manual errors, and reconciling accounts with few clicks. Take it for a spin today.

Want to know more? Schedule a demo with Zoho Books, a cloud accounting software, to see the power of banking up-close. Send us an email with a convenient date and time, and your contact details, to support@zohobooks.com.